Sign up for FREE access to our Commentary & Past Stock Picks

The CymorFund Blog is a subscription service. Blogs about stock picks we add to our portfolio are available immediately only to Premium subscribers. All Subscribers have immediate access to the other categories of our Blogs, including Stock Picks that we have sold.

The Craze Sweeping the Nation – Robo Investing

Recently all we hear about is “Robo Investing”. The themes vary between companies and sites offering the service, but in essence most sites – including the big banks – ask you to fill in the standard type forms that you would at any brokerage to open an account, then put your money in the account, and then let the automated service pick the stocks which your money is going to buy.

Of course the so-called automated service ranges from some portfolio manager in the background picking stocks (just like your current advisor), or some variation of computer assisted stock picking.

If you believe that some faceless, nameless automation can do better than your current advisor, perhaps you should try this service. After all, we should trust nameless, faceless people with our money, shouldn’t we ?

Why is Robo Investing Becoming Popular

There is a change sweeping the markets. Historically when you pick an advisor, he/she talks the talk, and is trained to give you confidence. After you are convinced and give your money to this individual, in many cases, this trusted advisor then simply gives your money to whichever seemingly good mutual fund he/she likes. Too often what determines which mutual fund the advisor picks, will depend on how much of a Rider the mutual fund will pay that advisor every month.

Nice job if you can get it.

Once a month the mutual fund sends the advisor a report (along with a check for the referral) and the advisor fancies up the report with in-house automated software and sends it off to you. So usually that check is between 1% and 1/2% of the current value of the investment.

What you are not told, is that the mutual fund pays out a lot of expenses from the money that you give them. They have audit fees, legal fees, mailing fees, lots of administrator fees, stock picker fees, bus boy fees, and other fees, and of course they have the expense of sending that check every month to the advisor.

But the Financial World is Changing

Under new rules coming into effect, your advisor is being forced to reveal to you just how much of your money is being taken from you by all of these parties with their hands in the trough. People in the industry are fearing this coming change and are trying their darnest to find other ways to make money, because the fear is that many investors will realize just how much they are paying, and they will desert their advisors in droves.

Enter the new concept – Robo Advisors.

Are Robo Investment Sites Good for YOU ?

That you will have to decide yourself.

We believe that Market Timing is extremely important. Will the Robo site takes this into consideration. Will the Robo site leave your money in cash when the markets look strained.

Will the Robo sites look to have your money invested, because leaving money in cash usually is not the most profitable for the advisor.

We believe that the general indexes may be fine, but they rise and fall. Over the long term of decades, many studies have shown indexes to be a valid investment. If you believe in that, perhaps ETF’s which completely track the market are for you. Their management fees are quite modest.

We believe that choosing specific stocks is the way to go, and we believe that buying and selling at peaks and valleys in the market is important. Does the Robo site do this. Does the Robo site do this any better than your advisor ?

Another View on Robo Sites

We came across the following article which discusses Robo Sites. You may find it of interest.

THE FELDER REPORT

Taking The Financial Road Less Traveled

Robo-Advisors Are Desperately Clinging To A Dangerous Dogma

I’ve recently argued that the success of passive investing potentially sows the seeds of its own demise. Patrick O’Shaughnessy also made a similar point recently and probably a bit more eloquently. But, to dig deeper into the push towards passive, there’s one big problem I have with virtually every one of the major robo-advisors that very few folks seem to be talking about. That is they all seem to advocate a heavily overweight position in equities, and for the most part this is skewed towards U.S. equities.

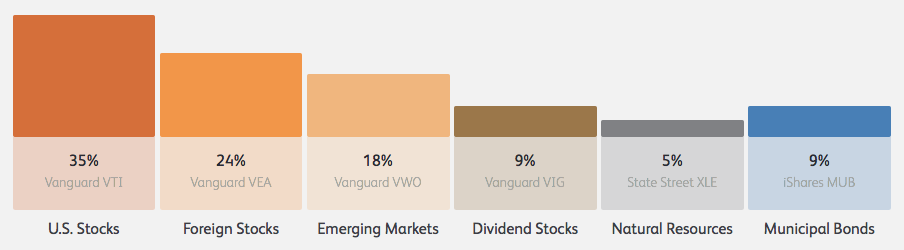

For example, below is the allocation WealthFront would put me in. It’s 91% in stocks, 49% U.S. stocks and 42% foreign, and 9% muni bonds. (This is their taxable allocation but the retirement allocation is very, very similar.)

I assume this massive equity overweight is simply based on the, “stocks for the long run,” dogma that everyone has bought into in recent years. The trouble with this is that it fails to take into account the simple fact that, in recent years and across a wide variety of time frames, bonds have outperformed stocks and with far less volatility, or what some might call, “risk.” As The Economist points out, “there was a point in 2011 when equities had lagged Treasury bonds over the previous 30 years.” 30 years!

Intrigued, I decided to run some of the numbers myself. The chart below tracks the difference in performance between Vanguard’s S&P 500 index fund versus their long-term treasury fund. It dates back to the start of 1999; that’s as far as StockCharts.com will let me go. Notice that since then, bonds have nearly doubled up on the performance of stocks and this includes some of the greatest years in stock market history! This time frame is especially compelling to me because stocks are currently valued, according to the Buffett yardstick and a few other valuable measures, just as highly today as they were back in 1999-2000.

We can also just look at the past 10 years. Stocks have had an incredible run recently; surely they’ve outperformed bonds over the past decade. Nope. Bonds win again and, if you owned them instead of stocks, you felt much better about your investments during the financial crisis and were thus much more likely to stick with your investment strategy through that difficult period.

So it’s fascinating for me to see so many hang on so fiercely to the idea that buying and holding U.S. stocks over any and all time frames is the way to go, despite their much greater volatility and lagging performance in recent years. And to see this dogma take form across every robo-advisor I’ve found just validates how deeply ingrained this dogma has now become.

In fact, WealthFront is so in love with the idea they wouldn’t put any of my money at all into long-term treasuries. Why not? Because they’re clinging to a dogma that perhaps worked at one point a long time ago, when stocks were more consistently fairly valued. But this dogma hasn’t worked for quite a long time now. Maybe this is why Ray Dalio’s firm, which has adopted just the opposite dogma – overweight bonds versus stocks because they offer better risk-adjusted returns over the long-term, has become the largest hedge fund firm by assets in the world.

Now I’m not saying you should forget stocks and put all your money in bonds. But there is a wonderful case to be made for diversifying across a variety of asset classes. WealthFront makes it appear as if they’re doing so. They’re not. In fact, they would just put all my money in the stock market and say, “good luck!” True diversification is something very, very different and also something far more valuable. Sadly, it may take another painful bear market in equities before the robos learn this important lesson.

This website and authors’ opinions are intended to be informative, but information contained is not guaranteed as being accurate or a complete statement or summary of available data. We assume no responsibility for errors, omissions, or contrary interpretation of the subject matter herein. Any perceived slights, omissions, or mis-statements of persons, peoples, or organizations or other published materials are unintentional. This information is not intended for use as a source of legal, business, accounting or financial advice, & readers are advised to seek services of competent professionals. No representation is made or implied that the reader will do well from using the suggested techniques, strategies, methods, systems, or ideas; rather information is presented for news value only. We do not assume any responsibility or liability whatsoever for what you choose to do with this information.

We may or may not have positions in securities we name. In making an investment decision consider numerous factors such as portfolio balancing, timing, cash and capital reserves, asset allocation and other. Do your own research. Matters discussed contain forward-looking statements that are subject to risks and uncertainties and actual results may differ materially from any future results, performance or achievements expressed or implied. Views expressed are opinions and not investment advice. You should retain a licensed professional to guide you. This report is neither a solicitation nor a recommendation to buy or sell securities. We are not a registered investment advisor nor a broker-dealer.