Sign up for FREE access to our Commentary & Past Stock Picks

The CymorFund Blog is a subscription service. Blogs about stock picks we add to our portfolio are available immediately only to Premium subscribers. All Subscribers have immediate access to the other categories of our Blogs, including Stock Picks that we have sold.

The Doomsayers Are Surely Disappointed

Been a bit of a delay since our last last blog – summertime and all.

What has consumed the doomsayers for a long while now, is their belief of an imminent economic fall. Their issues seem to be that there is too much debt in the world, and no way to repay the debt. The supposed answer is that gold will ‘multiply’ in price, and that the world will fall into a catastrophic depression for the next 3 decades. An interesting theory that fills lots of space and sells lots of advertising. Also a theory that successive events have proven just silly.

Let’ start with Spain. Remember when the debt crisis hit Spain and the world moaned and groaned about how Spain was going broke and would drag down Europe, and then the world with it? We go to Wikipedia for a description:

The 2008–15 Spanish financial crisis, also known as the Great Recession in Spain[1][2] or the Great Spanish Depression began in 2008 during the world financial crisis of 2007–08. In 2012 it made Spain a late participant in the European sovereign debt crisis when the country was unable to bailout its financial sector and had to apply for a €100 billion rescue package provided by the European Stability Mechanism (ESM).

So what happened?

The provision of up to €100 billion of rescue loans from eurozone funds was agreed by eurozone finance ministers on 9 June 2012.The turning point for the Spanish sovereign debt crisis occurred on 26 July 2012, when ECB President Mario Draghi said that the ECB was “ready to do whatever it takes to preserve the euro”. Announced on 6 September 2012, the ECB’s Outright Monetary Transactions (OMT) program of unlimited purchases of short-term sovereign debt put the ECB’s balance sheet behind the pledge. Speculative runs against Spanish sovereign debt were discouraged and 10-year bond yields stayed below the 6% level, approaching the 5% level by the end of 2012.[

The end result:

in 2013 it achieved a trade surplus for the first time in three decades.[20] In their global forecast report dated October 2014, the IMF improved the 2015 GDP growth forecast for Spain, putting it ahead of the Eurozone major economies.

Well, that Disaster Was Short-lived!

Let’s Move to Italy. Surely our fears will be borne out there. They spend, and spend, and spend.

Italy – Another Basket Case with Unsustainable Debt

Need I go into the details here? Once again, the debt was unsustainable. Doom was approaching.

Once again, other nations stepped in to maintain world economic stability and “WOW”, now no-one mentions any financial crisis in Italy.

Well, that Disaster Was Also Short-lived!

Let’s move to Greece . Greece is beyond help. A new government has been elected that has a mandate to reject all greater austerity measures. There is no middle ground left. They even held a referendum last week, which affirms the people’s decision to reject further austerity. Let the chips fall where they may!

Greece – The Banks Are Shutting. Woe is me!

That disaster was not short lived. It went on and on and on. Brinkmanship is the order of the day. The Greeks want to borrow more money, but they just want to put off the inevitable. They do however wish to stay in the EU with the Euro.

The EU sorely wants Greece to stay in the EU for a myriad of reasons.

So the European leaders, the financial leaders and others meet and negotiate – over months and months. Neither side has any alternative. It is either they agree, or they continue tp negotiate. There is no other course of action. Some say that Greece should depart the union, let the drachma fall, and then rejoin. All kinds of suggestions. In the end, YESTERDAY AN AGREEMENT WAS REACHED.

Greece will do what it has to to. Once again, no disaster!

What about Russia and the economic embargo over Ukraine?

That one continues, but this is a political war and a real war in addition to an economic issue. No one feels that unless a real World War breaks out between NATO and Russia (which is possible), there will be any major effect on world economies.

That Leaves The USA

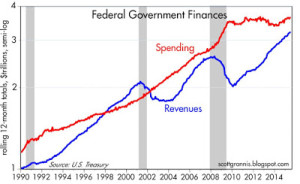

We borrow a chart from Calafia Beach Pundit to illustrate the point.

Spending is increasing a bit. Revenues are shooting up.

Should We Worry

The facts speak for themselves. The recovery cycle will be longer and greater than usual, just because the last fall was more disastrous and farther than any one since the great depression. The future is bright.

This website and authors’ opinions are intended to be informative, but information contained is not guaranteed as being accurate or a complete statement or summary of available data. We assume no responsibility for errors, omissions, or contrary interpretation of the subject matter herein. Any perceived slights, omissions, or mis-statements of persons, peoples, or organizations or other published materials are unintentional. This information is not intended for use as a source of legal, business, accounting or financial advice, & readers are advised to seek services of competent professionals. No representation is made or implied that the reader will do well from using the suggested techniques, strategies, methods, systems, or ideas; rather information is presented for news value only. We do not assume any responsibility or liability whatsoever for what you choose to do with this information.

We may or may not have positions in securities we name. In making an investment decision consider numerous factors such as portfolio balancing, timing, cash and capital reserves, asset allocation and other. Do your own research. Matters discussed contain forward-looking statements that are subject to risks and uncertainties and actual results may differ materially from any future results, performance or achievements expressed or implied. Views expressed are opinions and not investment advice. You should retain a licensed professional to guide you. This report is neither a solicitation nor a recommendation to buy or sell securities. We are not a registered investment advisor nor a broker-dealer.