Sign up for FREE access to our Commentary & Past Stock Picks

The CymorFund Blog is a subscription service. Blogs about stock picks we add to our portfolio are available immediately only to Premium subscribers. All Subscribers have immediate access to the other categories of our Blogs, including Stock Picks that we have sold.

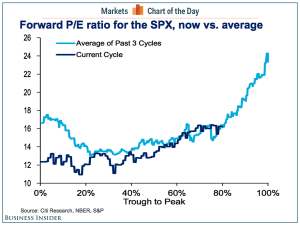

Stocks Have A Long Way to Rise

As in every cycle, there are many pundits who are crying ‘wolf’ by warning that a precipitous drop in the value of stocks is imminent. They use charts, magical portions, and nonsensical interpretations to prove their theses. If one followed this type of analysis in previous cycles, the investor would have missed most of the subsequent upside and would have sat on the sidelines watching everyone else making money.

A Picture is Worth a Thousand Words

A chart published today by Business Insider says it all.

Each cycle gathers steam as it slowly gathers strength. Then it becomes a bit aggressive and then things start getting out of hand, and values then start skyrocketing – until they are so high that they defy all logic. Then they crash. We haven’t even gotten close to that part of the cycle yet..

The following are direct quotes from the narrative published by Business Insider accompanying the dramatic chart above.

“The current 12-month forward P/E ratio is 16.8,” FactSet’s John Butters said on Friday. “This P/E ratio is above the 5-year average (13.8) and the 10-year average (14.1).”

But just because stocks are expensive relative to their long-term average is no guarantee that prices are doomed to fall immediately. Indeed, there are many instances in history when stock prices continued to rise and valuations continued to stretch for years before they corrected and reverted to the mean.

“Market multiples rarely trade at average levels,” Morgan Stanley’s Adam Parker once said.

The answer is obvious. Stocks are currently within an average valuation when compared to any reasonable previous period. There is zero IRRATIONAL EXUBERANCE. There is no bubble. There is no dramatic drop in prices on the near horizon.

This website and authors’ opinions are intended to be informative, but information contained is not guaranteed as being accurate or a complete statement or summary of available data. We assume no responsibility for errors, omissions, or contrary interpretation of the subject matter herein. Any perceived slights, omissions, or mis-statements of persons, peoples, or organizations or other published materials are unintentional. This information is not intended for use as a source of legal, business, accounting or financial advice, & readers are advised to seek services of competent professionals. No representation is made or implied that the reader will do well from using the suggested techniques, strategies, methods, systems, or ideas; rather information is presented for news value only. We do not assume any responsibility or liability whatsoever for what you choose to do with this information.

We may or may not have positions in securities we name. In making an investment decision consider numerous factors such as portfolio balancing, timing, cash and capital reserves, asset allocation and other. Do your own research. Matters discussed contain forward-looking statements that are subject to risks and uncertainties and actual results may differ materially from any future results, performance or achievements expressed or implied. Views expressed are opinions and not investment advice. You should retain a licensed professional to guide you. This report is neither a solicitation nor a recommendation to buy or sell securities. We are not a registered investment advisor nor a broker-dealer.