Sign up for FREE access to our Commentary & Past Stock Picks

The CymorFund Blog is a subscription service. Blogs about stock picks we add to our portfolio are available immediately only to Premium subscribers. All Subscribers have immediate access to the other categories of our Blogs, including Stock Picks that we have sold.

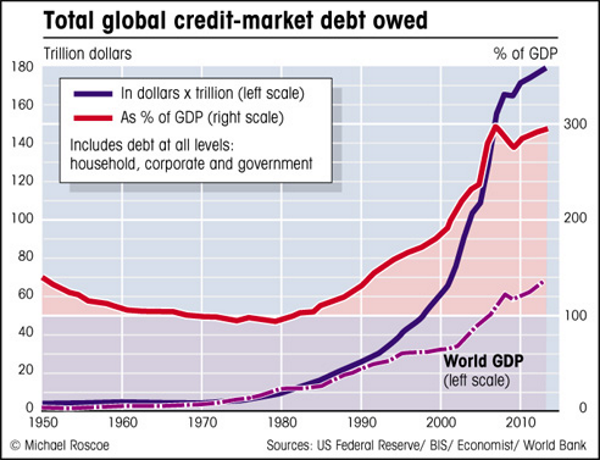

Global Debt Approaches 200 TRILLION

Following Excerpt Reprinted from Gold-Eagle

Debt is booming

Global debt is now in the region of $200 trillion. The McKinsey Global Institute recently published a report highlighting the bloated, unsustainable levels of debt that have been accumulated globally and the huge risks when interest rates begin to rise again.

McKinsey concluded that total global debt was $199 trillion and the little covered report was released in February – 3 months ago – meaning that the figure is likely over $200 trillion. With a global population of 7.3 billion this works out out at over $27,200 of debt for every man, woman and child alive in the world today.

Almost 29% of that debt – $57 trillion – has been accumulated in the relative short period since the financial crisis erupted in 2007 – just 8 years.

This has increased the total debt-to-GDP ratio by 17% and “poses new risks to financial stability and may undermine global economic growth.”

Chart reprinted from Gold-Eagle (http://www.gold-eagle.com/sites/default/files/obyrne051415-2.png)

Chart reprinted from Gold-Eagle (http://www.gold-eagle.com/sites/default/files/obyrne051415-2.png)

Scary Stuff – How to Interpret

In order to comprehend what is really happening, one has to examine various world economies and history.

The debt of Japan is growing, ever larger. The sheer size of the financial obligation to care for their aging population grows ever larger. No matter the amount of their export surplus, the debt numbers continue to grow larger.

The debts of China are also coming home to roost. All those empty buildings, and roads to nowhere, were built on debt. Quantitative Easing has now become the fixture in China. Noncollectable loans with government bailouts are ever more common.

Russia is an economic basket case with the value of the ruble diving. Even their enormous profits from the export of natural gas are not helping their collapsing economy.

The EU has seen the value of the Euro approach ever closer to par with the US$. Greece is teetering on withdrawal and no one knows the eventual outcome. Even the German economic powerhouse is not enough. Debts in Europe are increasing, not decreasing.

What about the USA?

The current debt is roughly equal to the comparable debt of the USA owing at the end of WWII. On a historical basis, the debt is large, but in context with history, it compares to at least two previous periods in USA history. Both times, that economic engine then powered ahead and made the debt irrelevant.

In spite of all the doom and gloom newscasters, the annual USA debt is decreasing at a rapid rate, and the economy is expanding at a rapid rate. I remind the reader of what happened at the end of Reagan era when the USA national debt had reached historic absolute numbers. During the early Clinton years, those massive deficits turned into surpluses, and in a few years the USA debts were gone. Simply gone because of the enormous economic powerhouse that the USA is.

The Tech Revolution

The USA today is in the midst of the next economic boom – this time a technical advancement boom. Facebook, Uber, Twitter, What’sApp and all the rest of the recent technological giant companies are only the forerunners of what is happening in the USA. Silicon Valley was the birthplace of many of these giant companies, and California continues to innovate and create hundreds and hundreds of new technology companies. The stream of innovation is far greater than at any time in history.

But now the newest and largest hotbeds of innovation and incubation are in New York City. Incubators are springing up everywhere – from the NorthEast coast, to Chicago, and elsewhere. The USA is undergoing a massive economic revolution that is dwarfing anything seen before. Just look at the newest IPO’s. They are no longer on NASDAQ. They are coming forth on all the major exchanges.

People are confused bu historical comparisons. The price of housing has not gone through the roof and people find that worrisome. Has the recovery fizzled? Not at all. This time it is a real economic boom, not a false economy based on inflated home prices. This time it is economic and technological growth.

The USA today has the strength, the economic power, the innovation and the resources to power ahead of all others, and in due course to drag the rest of the world behind them to a new economic prosperity.

This website and authors’ opinions are intended to be informative, but information contained is not guaranteed as being accurate or a complete statement or summary of available data. We assume no responsibility for errors, omissions, or contrary interpretation of the subject matter herein. Any perceived slights, omissions, or mis-statements of persons, peoples, or organizations or other published materials are unintentional. This information is not intended for use as a source of legal, business, accounting or financial advice, & readers are advised to seek services of competent professionals. No representation is made or implied that the reader will do well from using the suggested techniques, strategies, methods, systems, or ideas; rather information is presented for news value only. We do not assume any responsibility or liability whatsoever for what you choose to do with this information.

We may or may not have positions in securities we name. In making an investment decision consider numerous factors such as portfolio balancing, timing, cash and capital reserves, asset allocation and other. Do your own research. Matters discussed contain forward-looking statements that are subject to risks and uncertainties and actual results may differ materially from any future results, performance or achievements expressed or implied. Views expressed are opinions and not investment advice. You should retain a licensed professional to guide you. This report is neither a solicitation nor a recommendation to buy or sell securities. We are not a registered investment advisor nor a broker-dealer.