Sign up for FREE access to our Commentary & Past Stock Picks

Time to look at a junior miner approaching production. Perhaps a 10 Bagger. The CymorFund Blog is a subscription service. Blogs about stock picks we add to our portfolio are available immediately only to Premium subscribers. All Subscribers have immediate access to the other categories of our Blogs, including Stock Picks that we have sold.

Treasury Metals Inc (TML-TSXV)

In this period of difficulty for junior resource stocks, a few gems stand out with enormous potential. We judge this potential by their location, their access to capital, their conduct through the recent downturn, and their potential. Treasury Metals Inc meets all criteria.

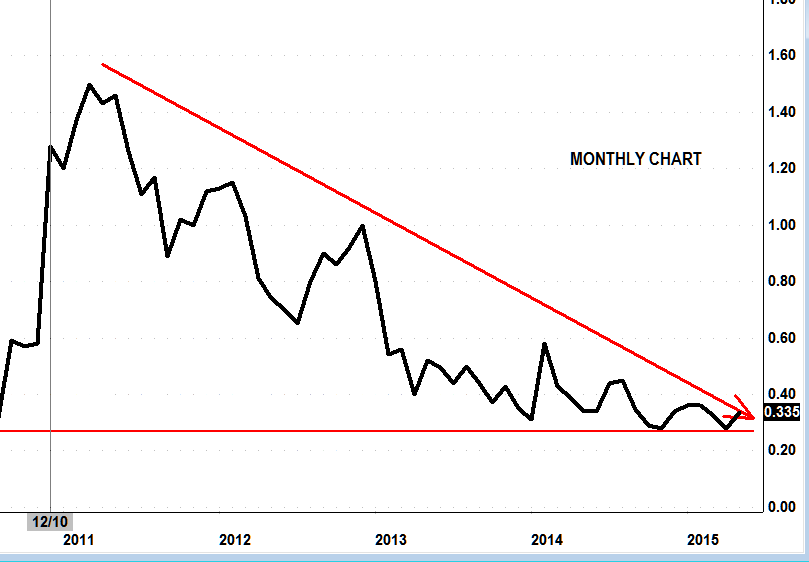

Stock Chart

It’s bargain time. When someone offers you a bargain and the goods are so inexpensive, a logical person buys the bargain. Look at the chart from 2011 until today. The company is alive and kicking. The project has continually advanced. Four years of effort has been expended, and still the price falls. Others have felt the pain. Let’s take the reward.

What is Treasury Metals

Toronto, Ontario–(Newsfile Corp. – March 3, 2014) – “We believe we will probably be the next gold project in Ontario to obtain mine permits,” says Martin Walter, President and CEO in an interview with SmallCapPower.com. He estimates the project will have all-in costs of $740 to $750 per ounce, and describes his company as being “fully funded” to complete a Feasibility and Environmental Impact Statement as well as an updated resource estimate later this year.”

Treasury Metals Inc. is a Toronto-based, TSXV-listed mining exploration and development company developing and permitting the Goliath Gold Project located in Northwestern Ontario. The Company’s flagship Goliath Gold Project is a high-grade gold resource that demonstrates strong market fundamentals, access to excellent infrastructure and a skilled local workforce. Treasury Metals has commenced the mine permitting process with the vision of a combination of an open pit and underground mining methods. Established in 2008, Treasury Metals operates corporate headquarters in Toronto and a project office at the Goliath Gold Project.

Some Highlights from the Company Website Presentation

The following is taken from the the company’s description of the project.

- 100%-owned high-grade, flagship Goliath Gold Project demonstrating an indicated and inferred resource of 1.7 Moz

- Results of 2013 drilling program have defined high-grade near-surface intersections, indicating significant upside potential for both resource and project economics

- Low initial start-up CAPEX of $92M with cash-flows from initial 3 years of open-pit production funding underground development

- Stable, mining-friendly jurisdiction of Northwestern Ontario

- Strong leadership team with successful capital markets, mine and operations expertise

So what we have here is an advanced project, with a great deposit, in a great jurisdiction, with low capex (cost to bring the project into production), a company that has advanced the project continuously while other similar companies have floundered in the poor market conditions, and a company that insiders believe so strongly in that they keep using their own money to buy shares.

Insiders Keep Buying

Mar 31/15 Yerly, Blaise F. – Acquisition in the public market 1,500 $0.310

Feb 11/14 Henderson, Marc Charles – Acquisition in the public market 25,000 $0.340

Feb 11/14 Henderson, Marc Charles – Acquisition in the public market 25,000 $0.340

Feb 11/14 Henderson, Marc Charles – Acquisition in the public market 50,000 $0.340

Feb 11/14 Henderson, Marc Charles – Acquisition in the public market 50,000 $0.340

Feb 4/14 Walter, Martin – Acquisition in the public market 100,000 $0.320

Feb 4/14 Yerly, Blaise F. – Acquisition in the public market 250,000 $0.330

Jan 6/14 Henderson, Marc Charles – Acquisition in the public market 50,000 $0.350

Dec 22/13 Walter, Martin – Acquisition under a prospectus exemption 100,000 $0.400

Dec 20/13 Ferron, Greg – Acquisition under a prospectus exemption 25,000 $0.400

This website and authors’ opinions are intended to be informative, but information contained is not guaranteed as being accurate or a complete statement or summary of available data. We assume no responsibility for errors, omissions, or contrary interpretation of the subject matter herein. Any perceived slights, omissions, or mis-statements of persons, peoples, or organizations or other published materials are unintentional. This information is not intended for use as a source of legal, business, accounting or financial advice, & readers are advised to seek services of competent professionals. No representation is made or implied that the reader will do well from using the suggested techniques, strategies, methods, systems, or ideas; rather information is presented for news value only. We do not assume any responsibility or liability whatsoever for what you choose to do with this information.

We may or may not have positions in securities we name. In making an investment decision consider numerous factors such as portfolio balancing, timing, cash and capital reserves, asset allocation and other. Do your own research. Matters discussed contain forward-looking statements that are subject to risks and uncertainties and actual results may differ materially from any future results, performance or achievements expressed or implied. Views expressed are opinions and not investment advice. You should retain a licensed professional to guide you. This report is neither a solicitation nor a recommendation to buy or sell securities. We are not a registered investment advisor nor a broker-dealer.