Sign up for FREE access to our Commentary & Past Stock Picks

A Gold Producing Junior at a Wonderful Bargain. The CymorFund Blog is a subscription service. Blogs about stock picks we add to our portfolio are available immediately only to Premium subscribers. All Subscribers have immediate access to the other categories of our Blogs, including Stock Picks that we have sold.

The Price of Gold

There is a fixation on the price of gold (which I will discuss in a future blog) and the crowd wants to buy gold producing companies only if the price of gold starts to move upwards. There is a minor move upward currently, but gold remains in a defined channel (see chart below). It hovers a bit above and a bit below $1,200, with the occasional temporary move above or below. Buying depending on both a share price movement, and a gold price movement, means that there is DOUBLE the RISK. A better method is to buy for value when the Risk Reward Ratio is on your side. Upward potential is large. Downward potential is less.

Gold price movement is not currently a criteria. Gold is in a channel and has been for quite a while. There is no indication that gold will move out of the channel. If a company can produce at a terrific profit at the current gold price, that is what the investor should be relying on.

The price of gold may jump upwards (or may not) for reasons discussed previously, but the important condition is that it will likely not plummet. That gold seems to have stabilized is the most Important Point. Today, most producing mines have an all in cost of over $1,000 /oz, with just a few companies having a cash cost as low as $600 / oz, but not many. The amount of gold being found in the ground is diminishing, and the demand for gold remains fairly consistent, as it has been forever. So there is a realistic floor on the value of the price of gold, and a continuing realistic demand for gold.

A company that is able to produce profitably at today’s value of gold, and further has a strong potential to increase production, is worth a hard look as an investment. True Gold fits those criteria.

True Gold Mining Inc

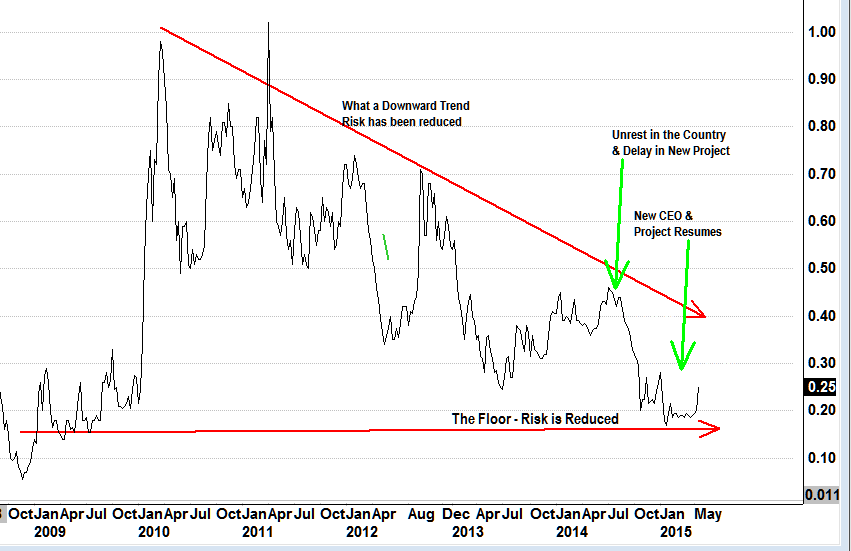

This is a classic tale of the stock price of a junior. A discovery is made causing the stock to skyrocket. Reality sets in that there will be tremendous dilution to raise enough money to get the gold out of the ground. Everyone loses interest over such a long period from discovery to production, Production starts and the stock shows some signs of life. A mishap – in this case some political unrest – and the stock plummets. NOW is the time to buy.

Where is It

This is open-pit heap leach gold mine in Burkina Faso, West Africa. Burkina Faso has many operating gold mines, is renowned for its political stability, is a mining friendly jurisdiction, and if one ventures out of North America, Burkina Faso is one of the best jurisdictions to be in.

What is It

This is a gold deposit that is shortly turning into an operating gold mine, with great potential, a very low cost of production, and the resources to quickly become a mid-tiered gold producer with a very high IRR and a potential to have the stock price shoot upwards as production advances. Financing is all in place, construction is rapidly advancing, and the potential is for a tremendous increase in gold resources owned by the company.

Why is It

This is a long story, and I will spare the reader the twisted turns and roadblocks overcome to get to this point. For those interested, it is a fascinating read. For those uncaring of history, and looking for a great opportunity, just look to the future.

The point is that the company has raised the funding necessary to put the mine into production, has done deals with the devil to get around all of the hurtles, has experienced political unrest and violence at the site, has changed its management, and on and on. What is important is that the stock has been beaten down so far, that the value is compelling.

This Week’s Press Release

VANCOUVER, B.C. – True Gold Mining Inc. (TSX-V; TGM) (“True Gold” or the “Company”) announced today that it has resumed activity at its Karma Gold Project (“Karma” or the “Project”) in Burkina Faso. The Company expects to pour first gold at Karma in March 2016. ……… Karma (the name of the gold mine) remains fully funded through construction to first gold pour, which is expected in March 2016. True Gold has $31 million in cash, and up to $62 million under our finance facility with approximately $70 million of project cost remaining. ……..

In other words, there is cash on hand sufficient to bring the mine into production, on schedule and within budget.

Some Quotes from TGM’s Recent Press Releases

The mine is a technically simple open-pit heap leach project that offers low capital and operating costs, rapid payback and strong financial performance. Once in production, Karma will be one of the lowest cost gold mines in West Africa with significant exploration growth potential that could add years to the life of mine. Economic highlights:

Feasibility Study1: After-tax IRR of 46.3%, NPV5% of $198.8 million @ $1,250/oz gold

Phase II – North Kao PEA1: After-tax IRR of213%, NPV5% of $69.6 million @$1,250/oz gold

Phase III – large resource base and multiple targets for long-term growth

Some Quotes from TGM’s Recent Presentations

Project Profile

Production: 97,000 oz Au/year average

All-in sustaining cash costs ($/oz): $678

RISKS

Obviously the greatest risk is that something happens between now and the start of production.

There was political strife (unusual in that area) which stalled the project and brought in new management. The government has issued official sounding pronouncements in favor of the project, but the government didn’t anticipate the last strife.

True Gold Mining Inc TSXV-TGM – $0.22

This website and authors’ opinions are intended to be informative, but information contained is not guaranteed as being accurate or a complete statement or summary of available data. We assume no responsibility for errors, omissions, or contrary interpretation of the subject matter herein. Any perceived slights, omissions, or mis-statements of persons, peoples, or organizations or other published materials are unintentional. This information is not intended for use as a source of legal, business, accounting or financial advice, & readers are advised to seek services of competent professionals. No representation is made or implied that the reader will do well from using the suggested techniques, strategies, methods, systems, or ideas; rather information is presented for news value only. We do not assume any responsibility or liability whatsoever for what you choose to do with this information.

We may or may not have positions in securities we name. In making an investment decision consider numerous factors such as portfolio balancing, timing, cash and capital reserves, asset allocation and other. Do your own research. Matters discussed contain forward-looking statements that are subject to risks and uncertainties and actual results may differ materially from any future results, performance or achievements expressed or implied. Views expressed are opinions and not investment advice. You should retain a licensed professional to guide you. This report is neither a solicitation nor a recommendation to buy or sell securities. We are not a registered investment advisor nor a broker-dealer.