Subscription Service

The CymorFund Blog is a subscription service. Blogs about stock picks we add to our portfolio are available immediately only to Premium subscribers. All Subscribers have immediate access to the other categories of our Blogs, including Stock Picks that we have sold.

Warnings About Unsustainable Debt

There are many charts and many pundits who issue severe warnings about our debt level being too high. Recently the Governor of the Bank of Canada warned Canadians that debt levels for individuals are at very high levels and growing. The USA newsletter writers are scrambling over each other to warn about margin levels in the USA, credit card debt levels, and so on.

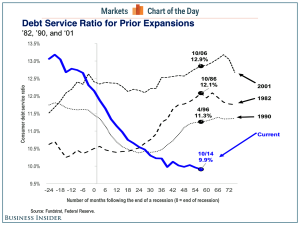

We copy a chart from Business Insider comparing this cycle to previous cycles in terms of how much money is being used to repay debt. There are a number of interpretations available for this chart. One could say that we are over spending, or one could say that there is a lot of excess money to spend, or whatever spin one wishes to put on the subject.

What I am saying is that the charts and numbers can be used to justify any position on the subject.

Society Changes Over Time

There were two major events in the 1900’s that defined our way of thinking. First the Great Depression, and then World War II. Both caused havoc in our society. Both destroyed wealth for the average American. People leaving farms in the Great Depression left with nothing. Soldiers coming home after WWII had to find a job and rebuild their lives. After both major events, society worried that there wouldn’t be enough money to pay the rent next month, or take care of our families next month. Add to that, the waves of immigrants that came to our shores penniless.

All of these factors and more, ingrained in us our basic belief that everyone had to save. If there was no money put aside for a rainy day, the consequences could be terrible. To this day, a basic tenet of living in America is the need to save, or so we are supposedly taught.

Inflation Anyone?

Fortunately, aside from a bout of inflation in the 1970’s, neither the USA nor Canada has experienced inflation. Don’t ask Mexicans about it. Their currency and their inflation has had numerous bouts of uncontrollable swings. I recall once when intending to travel to Mexico, I purchased pesos at one rate, and when I landed there the next day, the peso had dropped 20% in value. It turned out to be an inexpensive vacation for me. For Mexicans, it was a painful experience.

If you are in an inflationary environment, you spend your money as quickly as you can and you don’t save. The same goes for countries that are invaded and their new rulers pronounce the old currency worthless, as has happened often – especially in Eastern Europe.

Our Debt

For different reasons, but with the same effect, the old beliefs that ‘saving is the most important feature of everyday life’, are disappearing for our younger generations. Whatever metric of measurement you choose, debt is rising. The total credit card debt is rising. The total stock market margin debt is rising. Mortgage debt is rising as banks become less cautious with mortgage lending.

Our world has changed. Our media convince us every day that we need the newest Audi, or the Apple iWatch, or the most powerful computer, or the latest shoes. Society now lives on debt. It is a fact of life. People don’t buy very much with cash taken from beneath their mattress. People buy with credit, because credit is so easy. Every major operation offers a credit card. Every major store offers a credit card.

In spite of the disaster of 2008 when credit became unavailable, and in spite of all the warnings since, America lives on credit. The credit industry is enormously large and growing every day. It will not stop until we have inflation and interest rates jump dramatically. There is too much money being made by too many companies, by offering credit, to let this way of life disappear.

Forget the Hysteria. Watch the Economy

So fear not that debt levels are too high. Instead watch the inflation numbers. Currently inflation is so low that governments are printing money to actually create inflation – something that would have been considered heresy a few years ago.

When money becomes too expensive to borrow, then worry about debt levels, but until then, follow the economy, and ignore the warnings about debt. There is no change in inflation levels on the current horizon.

Cycles

The latest rage, is writers saying that the current economic cycle is aging and we had better watch out as the ‘bubble’ will burst soon. NONSENSE. We had a meltdown of monumental proportions in 2007 – 2008. We have not yet even recovered. Housing prices remain way below their peaks. Auto sales have only recently matched previous highs of almost a decade ago. Banks are still being monitored to see if they have sufficient capital as a result of the 2008 meltdown.

Some sectors are starting to boom, but the average American has not yet recovered. In techncal terms, the larger the plunge (and 2007-8 was a plunge of monumental proportions), the higher the recovery will go before the next end of cycle. We are still in the midst of recovery.

This website and authors’ opinions are intended to be informative, but information contained is not guaranteed as being accurate or a complete statement or summary of available data. We assume no responsibility for errors, omissions, or contrary interpretation of the subject matter herein. Any perceived slights, omissions, or mis-statements of persons, peoples, or organizations or other published materials are unintentional. This information is not intended for use as a source of legal, business, accounting or financial advice, & readers are advised to seek services of competent professionals. No representation is made or implied that the reader will do well from using the suggested techniques, strategies, methods, systems, or ideas; rather information is presented for news value only. We do not assume any responsibility or liability whatsoever for what you choose to do with this information.

We may or may not have positions in securities we name. In making an investment decision consider numerous factors such as portfolio balancing, timing, cash and capital reserves, asset allocation and other. Do your own research. Matters discussed contain forward-looking statements that are subject to risks and uncertainties and actual results may differ materially from any future results, performance or achievements expressed or implied. Views expressed are opinions and not investment advice. You should retain a licensed professional to guide you. This report is neither a solicitation nor a recommendation to buy or sell securities. We are not a registered investment advisor nor a broker-dealer.