In Spite of Disaster after Disaster, the Market Remains Strong

Take a look at the bad news coming from all sides.

War in the Ukraine

It is getting difficult to tell where events are headed in Ukraine. As a Bloomberg News headline puts it: “Putin Says No Immediate Need to Invade Eastern Ukraine, Leaves Threat Dangling.”

Bitcoin-exchange CEO found dead

The American CEO of a virtual-currency exchange was found lying motionless near the Singapore apartment tower where she lived.

Another bitcoin bank bites the dust, Flexcoin blames losses on hackers

US economy adds 175,000 jobs but unemployment rate rises to 6.7%

The US unemployment rate rose to 6.7% in February, even as the economy added more jobs than economists had expected.

China’s manufacturing activity shrinking says fresh report

The HSBC Purchasing Managers’ Index (PMI), which measures activity in smaller factories, fell to 48.5 in February from 49.5 in January – with Chinese New Year a possible factor.

Temperature Swings, Snowstorm Risk to Continue Next Week

Terrible weather everywhere with extremes of snow, cold, freezing, and storms. Economic numbers disappointing – blamed on extreme weather.

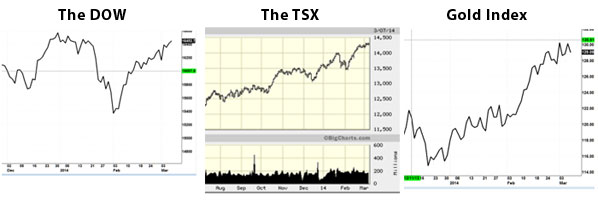

Now look at the Charts Above – doesn’t something seem out of SYNC?

The Economic Cycles

Reading the daily newspapers, or listening to social media, is akin to missing the forest for the trees. There are so many “trees'” – also know as bad news, or reported events – that many people are fearful and are waiting for the recovery before they invest in stocks.

As we have repeated so many times, the stock markets do not move in tandem with economic news, The stock markets move in cycles, as they have always done, and as they will always do. If you listen to the news, and if you ignore the reality of what the professionals are doing in the stock market, you will miss this TREMENDOUS OPPORTUNITY TO MAKE MONEY.

You make money in the markets by buying when bargains are available. Those that buy after stocks have reached new highs, are always hurt. Many people stay out of the market because of the fear generated by so many dramatic plunges in the markets in recent years, and by doing so they miss the great opportunity.

BUYING WHEN STOCKS HAVE REBOUNDED

It is a fool’s paradise. As the stock market rebounds, stock reach and exceed previous highs. Conservative investors take a long time to gain the confidence to invest in the market, and as they gain this confidence by waiting and watching, the current rise in the cycle moves through its early phases, and moves towards its plateau. Then when those conservative investors finally take the plunge, stocks have passed their peak. They are trading for more than they are worth.

Need I tell you what happens next – the NEXT PLUNGE.

The PDAC – The Prospectors & Developers Association of Canada – Annual Convention

In Canada, much of the market follows the resource sector, and the Annual Convention of the PDAC was this week. As you can tell by the name, this convention is centered around the resource industry. Everyone who is anyone, comes to this show.

The halls and presenting rooms are filled with

- resource-producing companies showing their assets

- resource exploring companies showing what they have

- people trying to raise money are everywhere, for every type of resource project you can imagine, located in every corner of the world

- prospectors trying to attract interest to what they have found

- investment bankers trying to drum up business

- investors trying to find the next great stock

- everyone selling goods and services to the industry

- and every other type of attendee that you can imagine

It is THE HOTBED of the industry. It is also the Bellwether of the industry.

The PDAC is held at the Toronto Convention Center and attracts about 30,000 people annually. It fills all of the Toronto hotels, the bars and restaurants do a banner business, all the entire city downtown is filled with activity resulting from this convention. It is held annually in early March.

In 2013, the halls were filled with gloom and doom. Attendance was dramatically reduced. As one walked the halls, people manning the booths were obviously bored, or disappointed, or depressed. Few came. Few deals were done. Little money was raised.

In 2014, it was a different story. The PDAC ended this week, and while it was nowhere near as crowded as in the boom years, it was busy. QUite busy. There were crowds at many booths. There were deals being announced. There were some very large financings announced.

The Mood

The important take away, is that there was a general feeling of optimism. Comments were repeated over and over how you could see signs that the depression in the resource market was beginning to lift. Everyone was extremely cautious, but also quite hopeful.

For those of us in attendance, it foretold of the next cycle that is now beginning.

While this website and the author’s opinions, are intended to be as accurate as possible, the information contained herein is based on sources which we believe reliable but is not guaranteed as being accurate or a complete statement or summary of the available data. We assume no responsibility for errors, omissions, or contrary interpretation of the subject matter herein. Any perceived slights, omissions, or mis-statements of specific persons, peoples, or organizations other published materials are unintentional.

This information is not intended for use as a source of legal, business, accounting or financial advice. All readers are advised to seek services of competent professionals in the respective fields. No representation is made or implied that the reader will do as well from using the suggested techniques, strategies, methods, systems, or ideas; rather it is presented for news value only. We do not assume any responsibility or liability whatsoever for what you choose to do with this information. Use your own judgment. There are no guarantees.

We may or may not have positions in securities we name. In making an investment decision consider numerous factors such as portfolio balancing, timing, cash and capital reserves, asset allocation and other. Do your own research. Matters discussed contain forward-looking statements that are subject to risks and uncertainties and actual results may differ materially from any future results, performance or achievements expressed or implied.

Views expressed are opinions and not investment advice. You should retain a licensed professional to guide you and not rely on the opinions expressed herein. This report is neither a solicitation nor a recommendation to buy or sell securities. We are not a registered investment advisor nor a broker-dealer. Any perceived remark, comment or use of organizations, people mentioned and any resemblance to characters living, dead or otherwise, real or fictitious, is purely unintentional and used as examples only.