Premier Gold Releases NI 43-101

VERY POSITIVE

March 14, 2014

On Feb 14, 2014, CymorFund highlighted Premier Gold @ $2.29. Today, Premier Gold (PG) released its NI 43-101 which is an independent Technical Report For The Preliminar

The numbers are very good, and this project is on its way.

The stock closed today at $2.53, which is an 11% gain. There is lots of upside in this stock.

The key aspects of the press release follows.

PREMIER GOLD MINES LIMITED (“Premier” or “The Company”) (TSX:PG) is pleased to confirm that it has filed a technical report (“Report”) prepared for the Hardrock and Brookbank Projects in accordance with Canadian Securities Administrators’ National Instrument 43-101. The Report may be found on the Company website or under the Company’s profile at www.sedar.com.

Highlights of the 2014 PEA Studies (all currency amounts in Canadian dollars unless otherwise stated) include:

Hardrock Project Estimates

- Average annual gold production during the first 8 years of 253,100 ounces with life of mine “LOM” (15 years) annual production of 202,700 ounces (including low-grade stockpiles).

- Average grade over the first 8 years of 1.50 grams per tonne gold “g/t Au” with a LOM average grade of 1.18 g/t Au (including low-grade stockpiles).

- Initial processing of 10,000 tonnes per day “tpd”, expanding to 18,000 tpd in Year 3.

- Pre-production capital costs of $410.6 million including $83 million for contingency.

- Pre-tax net present value “NPV” (at a 5% discount rate) of $519 million at US$1250 gold and an exchange rate of CAD$1.00 = US$0.95.

- Pre-tax internal rate of return “IRR” of 23.0% and a 3.5 year payback at US$1250 gold and an exchange rate of CAD$1.00 = US$0.95.

Brookbank Project Estimates

- Pre-tax NPV (at 5% discount rate) of $73.8 million and IRR of 30.1%, at US$1250 gold and an exchange rate of CAD$1.00 = US$0.95, when rock is trucked to Hardrock versus stand-alone processing option. On an After-Tax basis, NPV (5%) is $49.9 million and IRR of 24.2%.

- Average annual gold production during LOM (7 years) of 48,700 ounces.

CymorFund’s Original Report of February 12, 2004 Follows:

CymorFund 10-Bagger Highlights: Premier Gold (PG-TSX $2.29)

February 12, 2014

A Canadian Gold Story

Premier Gold Mines Limited is a unique gold story. It has strategic properties in safe and historical gold producing districts in Canada and in Nevada, USA. It started just before the 2008 stock market meltdown, and survived. It survived the 2013 gold resource meltdown. It has a stellar management and board of directors. It has lots of cash, and is undervalued.

What more can you ask for?

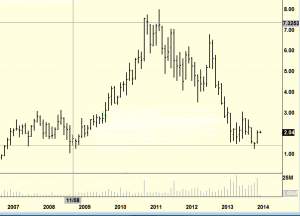

We Start With a Ski Hill Chart

If you follow gold stocks, the above chart says it all. Premier started with great enthusiasm in 2006, fell in 2008 when everything fell, rose again as the gold stocks caught fire, and then plummeted in 2013 when Wall Street harvested all the money from junior gold miners, by driving each one of them DOWN, DOWN, DOWN.

BUY WHEN BARGAINS ABOUND

The stock market is a place where the uninitiated get killed. Stocks are driven up, or down, on an extremely exaggerated basis, which bears little resemblance to their true value. If you want to make real money, you follow the timing of the market, and BUY WHEN BARGAINS ABOUND.

The Premier Story Starts in 2006

THUNDER BAY, ON, Aug. 17 /CNW/ – WOLFDEN RESOURCES INC. (TSX:WLF) is

pleased to announce that the arrangement (the “Arrangement”) involving Premier

Gold Mines Limited (“Premier”), which was approved by the shareholders of

Wolfden on June 28, 2006, was approved by an order of the Ontario Superior

Court of Justice and is expected to become effective on August 18, 2006.

Pursuant to the Arrangement, each shareholder of Wolfden will ultimately

receive one new common share of Wolfden and 0.70 of a common share of Premier

Like All Golds, The Stock Fell Out of Favor

As it fell, it bounced off the support line and moved, then retreating. When it broke through the support line, it quickly fell farther and faster. When it finally started to recover, it broke through the (now) resistance line, which again become a support line. A classic chart actually. The following chart with the green arrows illustrate the movement.

What is more immediately relevant, is the strong upward channel that the stock is now moving in.

What is happening now, is that the market is recognizing Premier Gold for the gem that it is. Since PG reached a ridiculous low of $1.28 in December 2013, it has consistently risen in a continuing uptrend, reaching $2.51 yesterday. There are 2 immediate factors driving this relentless upward drive.

- Firstly, the price of the precious metal itself – GOLD -has held above the $1,200 level, and regardless of Wall Street manipulations, it is inexorably rising again, breaking through the $1,270 level and now approaching $1,300.

- Next, The market is realizing how undervalued PG is, and value buyers are moving back into the stock.

Compare the Remarkable Charts Below. The Rising 60 Day Chart for Gold and the Rising 60 Day Chart for PG

Like mirror images, aren’t they.

What Does Premier Have?

Rahill-Bonanza Joint Venture – Ontario, Canada (49%PG – 51%G)

Premier has a prime deposit in the Red Lake prolific gold bearing area of Eastern Ontario, adjacent to Goldcorp’s rich deposit, in a Joint Venture with Goldcorp, the world’s richest gold mine. Premier was involved with Goldcorp in the creation of the world famous massive 6200-metre-long fully ventilated tunnel connecting Cochenour Mine and Goldcorp’s Campbell Mine.

Drilling underground by Premier is being conducted through access provided by this massive tunnel. This is exploring for gold deep underground through the existing infrastructure, with the parties confident enough enough in the potential that this impressive tunnel and infrastructure was built. The average grade of gold determined to date is 6.46 g/t, which is quite rich, and roughly 500,000 ozs/Au has been determined to date. Active substantial drilling continues, and the company has high hopes that one of the continuations of the rich Goldcorp veins rests on its property. A new zone was recently discovered with initial asseys returning up to 134.7 g/t across 0.3 m. Results from the recent drilling are scheduled to be released shortly.

The Trans-Canada Property – Ontario, Canada (100% owned)

The property is adjacent to the Trans Canada highway and consists of 4 separate discovered gold mineral resources, with much more potential. The largest current being the Hardrock Deposit, and the second largest being the Brookbank Deposit. The Hardrock has Preliminary Economic Assessment Studies completed on areas drilled, with ongoing drilling delineating further resources and new targets.

Hardrock Current PEA metrics are:

- an ANNUAL GOLD PRODUCTION of 253,000 ozs @ 1.5 g/t for 8 years,

- a life of mine for 15 years,,

- a recovery of 89%,

- a capex of $410 million,

- a payback of 3.5 years,

- cash costs of $652, all in costs $737 (making the proposed mine extremely profitable at today’s gold price,

- an Open pit M&I of 2,885,000 ozs/Au, Inferred of 1,043,000,

- an Underground Mine of 1,124,000 M&I, and Inferred 2,985.

This is a total of almost 8,000,000 ozs/Ag AND GROWING. Construction hopefully to start 2014 or 2015.

Brookbank PEA metrics are:

- a 4.3 year payback

- a 7 year life of mine

- combination of early years open pit, and subsequent underground mining

- Capex $106 million

- this deposit is much smaller and will be considered a feeder to the mill being constructed for Hardrock.

Cove Gold Project, Nevada (100% owned)

A much earlier stage exploration/development project in the heart of the prolific Battle Mountain – Eureka Trend. They are discovering new zones of gold potential in proximity to the Cove open pit Project, which is the 4th largest silver producer in the history of Nevada.

The company holds out this project with high hopes.

Management & Directors

This is a company filled with strong industry veterans, who have a stellar history in the space, with successes at Wolfden Resources (acquired 2006 by Zinifex), Agnico Eagle Mines, Goldcorp, Meadowbank, and more.

The CEO is a famed industry stalwart – Ewan Downie. The Chairman is Ebe Scherkus who was President & COO of Agnic Eagle, and the list goes on.

There is a tried and true adage – FOLLOW SUCCESS. Management is always more important than hard assets.

Company Stats

- Currently over $70 million in cash

- Outstanding shares – 151 million, fully diluted 164 million

- No warrants, which is almost unheard of in the industry

- Market Cap $348 million.

CymorFund 10-Bagger Stock Picks – Buy Premier Gold (PG-TSX $2.29)

While this website and the author’s opinions, are intended to be as accurate as possible, the information contained herein is based on sources which we believe reliable but is not guaranteed as being accurate or a complete statement or summary of the available data. We assume no responsibility for errors, omissions, or contrary interpretation of the subject matter herein. Any perceived slights, omissions, or mis-statements of specific persons, peoples, or organizations other published materials are unintentional.

This information is not intended for use as a source of legal, business, accounting or financial advice. All readers are advised to seek services of competent professionals in the respective fields. No representation is made or implied that the reader will do as well from using the suggested techniques, strategies, methods, systems, or ideas; rather it is presented for news value only. We do not assume any responsibility or liability whatsoever for what you choose to do with this information. Use your own judgment. There are no guarantees.

We may or may not have positions in securities we name. In making an investment decision consider numerous factors such as portfolio balancing, timing, cash and capital reserves, asset allocation and other. Do your own research. Matters discussed contain forward-looking statements that are subject to risks and uncertainties and actual results may differ materially from any future results, performance or achievements expressed or implied.

Views expressed are opinions and not investment advice. You should retain a licensed professional to guide you and not rely on the opinions expressed herein. This report is neither a solicitation nor a recommendation to buy or sell securities. We are not a registered investment advisor nor a broker-dealer. Any perceived remark, comment or use of organizations, people mentioned and any resemblance to characters living, dead or otherwise, real or fictitious, is purely unintentional and used as examples only.