Temex Resources Corp (TSXV-TME) $0.085

January 22, 2014

We have done amazing well on our CymorFund 10-Bagger stock picks, and today we take advantage of the extremely depressed junior resource market. We think the junior resource market is improving. Many resource stocks have had a major bounce in the first 3 weeks of 2014, and we believe that the downward plunge is reversing.

It is time, to take measure the risk and and buy value.

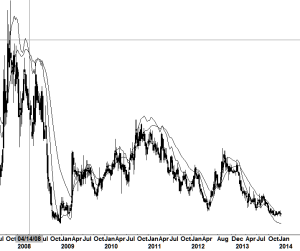

The Stock Chart

It doesn’t get much worse than this one. Temex has been around since 2003 when it was trading over $1.00. It fell to below $0.20 in 2005, rising in 2006 to $0.80, then falling to the $0.20 level, and then rising in 2008 to almost $1.00.

Then, like all junior resource stocks, with the 2008 market meltdown, the stocks crashed and burned, and this stock did also. It fell to below $0.05. Then guess what happened? It recovered to $0.45 and then started a long slide exaggerated by the 2013 junior resource stock market meltdown, ending up where it is now – around $0.08.

Buy Based on History?

If this was our criteria for buying, this would be a no-brainer. The stock jumps, then it falls, then it recovers, then falls, then recovers, and on and on. If you believe in history repeating itself, buy the stock. It is so low, that based on its history, it has to recover.

We don’t believe that history is relevant. We do believe that following market cycles, allows investors to make the most money. The stock market is, and always has been, a roller coaster. To coin a phrase uttered by the great money printer, Alan Greenspan, “irrational exuberance” pops up its ugly head, and when it does it allows sophisticated investors to make lots of money. Stocks rise too far when everyone is jumping on the bandwagon, and fall too far when everyone becomes afraid. The real value of a stock is rarely what the stock market’s quote for the stock is.

If you follow our Investment Newsletter, we have often described the cycles that the stock market goes through, and if you believe in the fabled investor Warren Buffet, you buy when everyone is afraid, and you sell when everyone is rushing in.

Let’s look at Temex.

The following is taken from their website.

The Temex strategy is the acquisition of low risk gold projects in the world class mining region of northeastern Ontario, Canada. The mission is to rapidly advance these gold projects by executing the necessary work to efficiently develop these projects towards advanced exploration and pre-development stages.

Two key gold projects, Whitney in the center of Timmins, Canada’s largest gold camp, and Juby located 100 kilometres to the south, both with NI 43-101 gold resources, have considerable upside with significant value yet to be realized providing a solid platform for immediate and long term growth

So we start with the basics.

- the company operates in a very safe jurisdiction – Ontario, Canada

- the management is competent, has been there a long time, and is knowledgeable

- there is definitely a discovered resource in the ground rather than pie in the sky

- the company is the middle of gold finding territory that is the location of many other discoveries

- infrastructure surrounds them from other gold producing companies

- as at the last quarter published in 2013, the company had cash reserves of over $4,000,000

So the basics are there. This is a real company. Now we ask, “Does it have real prospects?”

The Market

As we all know, the junior resource market has been in terrible shape, and gold exploration companies have suffered as much as anyone. Yet the companies with decent deposits and good management have weathered the storm – bruised and battered, but still there. The survivors of the junior meltdown carnage are being recognized as potential winners. In the last few weeks, a series of brokerage houses have issued reports on Temex with price targets ranging from $0.35 to $0.45. Now an analyst is never going to pick a penny stock and give a target price that is 10 times the current price. The penalty for being wrong is “find another job”.

The key is that if this stock rises to $0.40, it will be because the deposits keep expanding, the production costs remain in control, and if the estimate of anticipated production of 65,000 ounces/year is met, the vale of the stock will be far higher than current targets.

Remember that only a few months ago, the targets were 1/2 of what they are now.

Production

The goal of any explorer is find an economical gold deposit, that allows gold to be produced at a profitable level. We believe that Temex has done this. At the current market price for gold, the Temex deposits can be mined, extracted and sold at a handsome profit.

The next question is “Is there enough gold in the ground to mine profitably?”

Most analysts project a production of around 700,000 ounces / year at a cost under $600 / ounce. At anywhere near these numbers, this operation will be very profitable.

What Does Temex Have?

It has a high grade near surface deposit of gold with an average grade of 6.85 g/t containing over 700,000 ounces of gold called the Whitney Deposit. This deposit continues to grow and has the potential to much, much larger. Goldcorp owns 40% of this deposit. The latest results released in January 2014 show a growth of over 80% since their last estimate.

It has a 100% owned Juby deposit in the same area with over 4,000,000 M&I gold ounces, of a lower grade, but still easily mineable, and this deposit is wide open for expansion and increase in resources.

The company has other projects, but these two large deposits are quite impressive without the need for further assets.

Overall, it has the potential to become a mid-tier gold producer within a few years.

What is most interesting, is that the figures released so far, and those same figures upon which everyone is modelling the future of the company, do not include major amounts of drilling which have not yet been properly assayed, measured and verified, and do not include all of the potential of the deposits which are continuing and open, and have not yet been drilled. There is major additional potential.

The Company

Temex has too many shares out – around 160,000 with another 20,000 million or so in warrants and options, for a total reaching almost 180,000 shares outstanding. This sheer number of shares could cause difficulty for the stock price as there are lots of shares to buy and sell.

At at market price of $0.085, that puts the value of the company at only 15,300,000. This on a rough basis works out to have the unmined gold in the ground valued at something less than $3.00 per ounce, which is very cheap.

Risks

If you believe that the price of gold will fall dramatically, this stock will collapse further. Some of the large Wall Street brokerages has put out statements saying that they believe the price of gold could fall to as low as $1,000 / ounce, before recovering. We do not subscribe to this theory. Without going into lots of detail, we believe the price of gold has stabilized between $1,200 & $1,400 / ounce, and if there is further decline, it will be temporary.

Each time the price of gold has fallen in the last while, it has recovered to the $1,400 level. China, India and world economic disturbances have not disappeared. They are all alive and well. China continues to grow and demand more gold. India is actually putting large restraints on the purchase of gold, which is not dampening enthusiasm. And wars, revolutions, economic collapses, and localized inflation will be around a lot longer than we will. Gold remains in demand.

There is always the risk that the demand for gold will reduce. There is always the risk that the cost of production will grow. There is always the risk that the company will be unable to raise sufficient funding to carry forth on its projects.

The greatest risk is that a mid sized gold company will make a hostile bid for this company, and a successful bid might be at a far lower price than expected if the market has not yet recognized the value here.

CymorFund’s 10-Bagger Stock Pick – Buy Temex Resource Corp – $0.085 (TSXV-TME)

While this website and the author’s opinions, are intended to be as accurate as possible, the information contained herein is based on sources which we believe reliable but is not guaranteed as being accurate or a complete statement or summary of the available data. We assume no responsibility for errors, omissions, or contrary interpretation of the subject matter herein. Any perceived slights, omissions, or mis-statements of specific persons, peoples, or organizations other published materials are unintentional.

This information is not intended for use as a source of legal, business, accounting or financial advice. All readers are advised to seek services of competent professionals in the respective fields. No representation is made or implied that the reader will do as well from using the suggested techniques, strategies, methods, systems, or ideas; rather it is presented for news value only. We do not assume any responsibility or liability whatsoever for what you choose to do with this information. Use your own judgment. There are no guarantees.

We may or may not have positions in securities we name. In making an investment decision consider numerous factors such as portfolio balancing, timing, cash and capital reserves, asset allocation and other. Do your own research. Matters discussed contain forward-looking statements that are subject to risks and uncertainties and actual results may differ materially from any future results, performance or achievements expressed or implied.

Views expressed are opinions and not investment advice. You should retain a licensed professional to guide you and not rely on the opinions expressed herein. This report is neither a solicitation nor a recommendation to buy or sell securities. We are not a registered investment advisor nor a broker-dealer. Any perceived remark, comment or use of organizations, people mentioned and any resemblance to characters living, dead or otherwise, real or fictitious, is purely unintentional and used as examples only.