Contrary to Public Perception, The 2013 USA Deficit is Reducing Dramatically

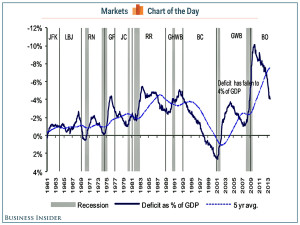

Today we borrow a post from Business Insider – their Chart of the Day shows the US deficit is now down to 4% of GDP. For all those that think the current impasse between the Republicans and the Democrats is a fight over outrageous spending, it seems that everyone gathers that the spending must be reduced, and being reduced it is.

The Chart is most dramatic and tells a very important story. The US economy is mending and the start of the next boom is stirring.

CHART OF THE DAY: Barack Obama Is Totally Torpedoing Deficit Level

Any debate about debts and deficits becomes much more robust when the numbers are considered relative to the size of the economy.

“Under Obama, the deficit is falling from 10% of GDP to just 3%,” tweeted MSNBC’s Ari Melber. “But only 6% of America knows it.There’s often a misconception that a democratic President would be more likely to raise these ratios by promoting big government.But the reality is quite the opposite.As you can see from this chart from Deutsche Bank’s David Bianco, Obama has been one of the most effective presidents in American history to reduce deficit levels.

Sign up for CymorFund’s Stock Picks Investment Newsletter at www.cymorfund.com.

Articles on specific stocks, commentary and explanation of the stock markets and stock trends.

The Strength of the US Economy

There is much confusion over the strength of the US economy. Followers of politics believe the US is being decimated by the ‘socialist’ policies of the current administration. Other believe the US has exported its manufacturing ability and jobs overseas, never to be recovered. Others may have read ‘The Unwinding’ by George Packer, which is a dismal tale of people struggling with economic loss and disillusionment of the US political system. It is a series of discussions all founded on bits of truths, while ignoring the largest most important fact.

As we have seen through the decades, through its ups and downs, through the never ending cycles of boom and bust somehow that weird system of checks and balances that comprises the US system of government and of economics, always rises to the surface.

It is a bit of a difficult system, in that those less fortunate are often left behind. Those beaten down often never recover. Those wo are not part of the Wall St elite, often don’t have a decent chance.

But overall, the economic powerhouse that is the USA continues to chug along – through thick and then through half – truths, and mis-truths, through the lies and deceit, still that system and that economy powers the modern world.

Investing

As with every cycle, one must invest at the start of the cycle, never at the eight of the madness. Pick stocks that are for the future, and know those stocks will rise in the future.

We may or may not have positions in securities we name. In making an investment decision consider numerous factors such as portfolio balancing, timing, cash and capital reserves, asset allocation and other. Do your own research. Matters discussed contain forward-looking statements that are subject to risks and uncertainties and actual results may differ materially from any future results, performance or achievements expressed or implied.

Views expressed are opinions and not investment advice. You should retain a licensed professional to guide you and not rely on the opinions expressed herein. This report is neither a solicitation nor a recommendation to buy or sell securities. We are not a registered investment advisor nor a broker-dealer. The information contained herein is based on sources which we believe reliable but is not guaranteed as being accurate or a complete statement or summary of the available data.

This statement from this article: “Obama has been one of the most effective presidents in American history to reduce deficit levels.” is the biggest lie ever made. Obama is absolutely the LEAST effective [fraudulent] president in American history to reduce deficit levels. He is a spend-a-holic and thinks USA wealth is his to redistribute and dispose of all by himself. If anyone believes “Obama has been one of the most effective presidents in American history to reduce deficit levels.” it’ll prove that the bigger the lie the more it will be believed.