Sign up for FREE access to our Commentary & Past Stock Picks

CymorFund likes Renforth Resources and recently purchased a position in Renforth’s Private Placement. In this placement, Renforth raised $600,000 at a ridiculously cheap valuation.

Cymorfund hopes this will be a 10-bagger.

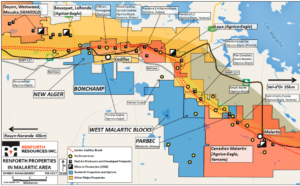

Renforth Resources, listed on the CSE (RFR), is a junior gold explorer with advanced-staged gold projects in the Malartic area of Quebec. This area hosts the Malartic mine, which is the largest open pit gold deposit mine in Canada (hosting over 10 million ounces of gold) as well as several gold mines operated by companies such as Agnico Eagle Mines Ltd, Iam Gold Corporation and Yamana Gold Inc.

Renforth has a large land package which ties directly on to the Malartic Mine property, and includes some historical gold properties as well as very prospective properties..

Renforth’s Holdings

Prominent holdings of Renforth are:

- the New Alger mine

- the Parbec option

- the Malartic West claim group tied directly on the former Osisko mine, now called the Malartic Mine,

- and other claims (see below).

If you examine the map of the Malartic lands on the Cadillac Break, you see how Renforth’s significant land positions are strategically located, some with historic gold reserves, running mostly on the south of the Malartic property and abutting that property on the west and on the east, as well as the dynamic Parbec which cuts into the Malartic property on the north.

Parbec, on a never mined portion of the Cadillac Break, is contiguous to the Canadian Malartic super pit mine and its 10 million ounce resource (2014), and immediately adjacent to the East Amphi mine resource portion of Canadian Malartic.

An Unrecognized Gem

Location. Location. Location.

If one wished to hold gold property in Canada’s foremost producing gold district, this is it.

Renforth Resources’ land holdings are most impressive, and contain significant gold reserves, and best of all, the market has not yet recognized this gem. But Renforth will be recognized for the valuable assets that it holds.

And More

Renforth has Nicole Brewster as its CEO, an experienced mining lady from a noted experienced mining family. This very knowledgeable CEO keeps improving Renforth’s position.

On March 8, 2017, Renforth announced the acquisition of the Denain Gold Project, located n the Cadillac Break, approximately 10 km east of the former Chimo Mine. The Project, comprised of 145 claims over ~7700 Ha, hosts the Americ Au Occurence and the Matchi – Manitou and Sullivan Cu/Zn Occurences.

And Still More

SOQUEM, the exploration arm of the Quebec government, just announced a serious interest in Renforth’s Malartic West Property. SOQUEM will spend $300,000 in exploration in year one + an option to spend additional $1,000,000 in the next two years to earn a 50% interest in this land holdings. MOST IMPRESSIVE.

Some Notable Gold Numbers

Renforth’s New Alger mine lies one mile west of the SOQUEM-Renforth joint venture. It was shut down in 1954 due to then very low gold prices. At today’s gold price, it has become a valuable asset. Renforth owns a 100% interest in this deposit. Nicole Brewster CEO is proving very adept in furthering the company’s assets.

The new Alger mine has a shaft down to 1160 ft with eight underground levels. There are 200,000 oz of gold blocked out with the potential to more than triple this amount. Drilling in 2014 gave some of the following impressive results;

Hole 17 – 2.5g/t Au over 4.5 M

Hole 18 – 12.8 g/t Au over 7 m,

incl. 31 g/t Au over 2.7 m

incl. 5 oz Au over .5 m

Hole 19 – 2 g/t Au over 11 m

Also Property in Timmins

Funding and Operating Costs

Renforth’s recent Private Placement raised over $600,000 at $0.05 a unit. This capital raise will go into exploration and drilling expenses. Renforth management operates on a shoestring and has minimal operating costs. Renforth’s CEO is determined to make her reputation on this Company and doesn’t waste precious capital on management expenses and frills.

Renforth sounds good to me.